Math 5.10

Personal financial literacy. The student applies mathematical process standards to manage one's financial resources effectively for lifetime financial security. The student is expected to:

- (1) define income tax, payroll tax, sales tax,

and property tax;

- (A) explain the difference between gross income and net income;

- (B) identify the advantages and disadvantages of different methods of payment, including check, credit card, debit card, and electronic payments;

- (C) develop a system for keeping and using financial records;

- (D) describe actions that might be taken to balance a budget when expenses exceed income; and

- (E) balance a simple budget.

- Plus Plan

Math in the Real World - Budgeting Planning Project

Introduce your students to the world of making a budget with an immersive “It’s My Life” budgeting for kids project.

- Plus Plan

Financial Literacy Word Wall

Use this set of financial literacy vocabulary cards when teaching about income, budgets, taxes, methods of payment, and financial records.

- Plus Plan

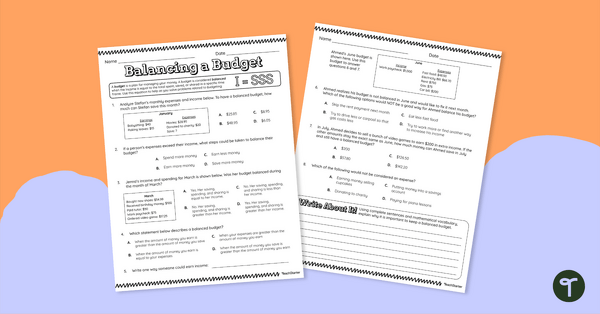

Balancing a Budget – Worksheet

Practice how to balance a budget with this financial literacy worksheet.

- Plus Plan

Financial Literacy for Kids - Finance Word Wall

Introduce your students to the world of financial literacy with an illustrated personal finance word wall for kids.

- Plus Plan

Grade 5 Daily Warm-Up – PowerPoint 1

A 75-slide PowerPoint presentation containing a variety of quick warm-up activities.

- Plus Plan

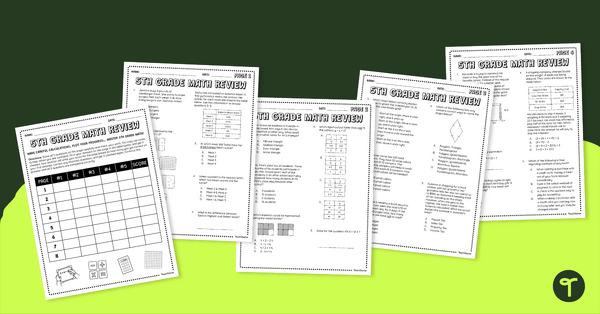

5th Grade Math Review – Test Prep Packet

Encourage your students to work through 8 pages of 5th-grade math problems while charting their progress to measure their success.

- Plus Plan

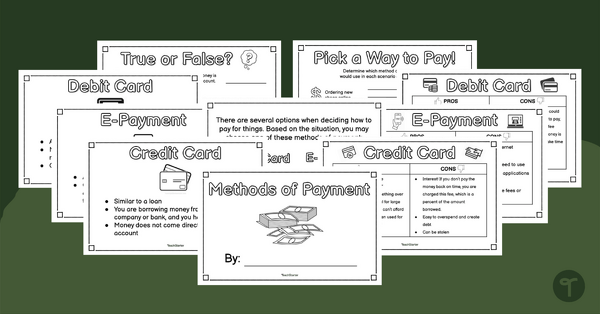

Methods of Payment Mini-Book

Learn about the advantages and disadvantages of different methods of payment with this mini-book.

- Plus Plan

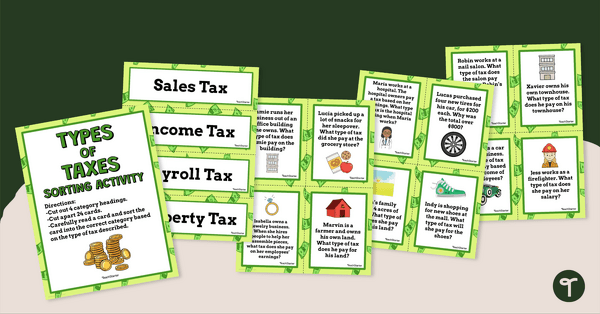

Types of Taxes – Sorting Activity

Differentiate between different types of taxes with this 24-card sorting activity.

- Plus Plan

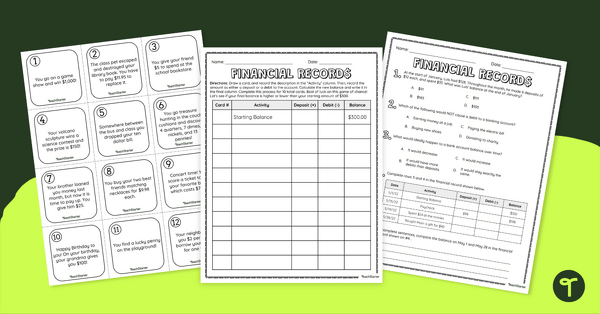

Financial Records Independent Game

Engage your students with an independent game while learning how to keep and use financial records.

- Plus Plan

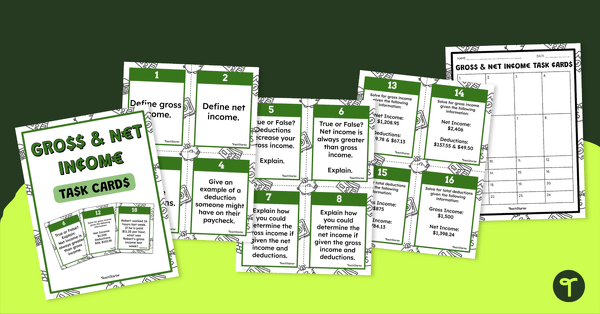

Gross and Net Income – Task Cards

Explore the difference between gross income and net income with this set of 24 task cards.

- Plus Plan

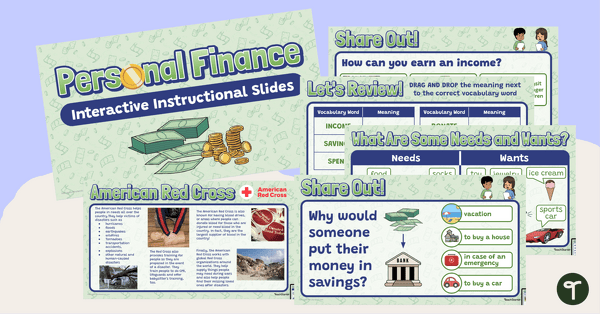

Financial Literacy for Kids - Instructional Slide Deck

Teach your students the ins and outs of financial literacy with an instructional slide deck.